PERCETAKAN NASIONAL MALAYSIA BHD 2006 Act 53 INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM. The ITA 1967 was first enacted in.

Taxation Of Foreign Source Income In Malaysia International Tax Review

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and.

. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and. A in respect of a period of five years commencing from the date of registration of such co-operative society. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through.

Introduction The Income Tax Act 1967 ITA 1967 is the main source of reference governing the income tax system in Malaysia. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

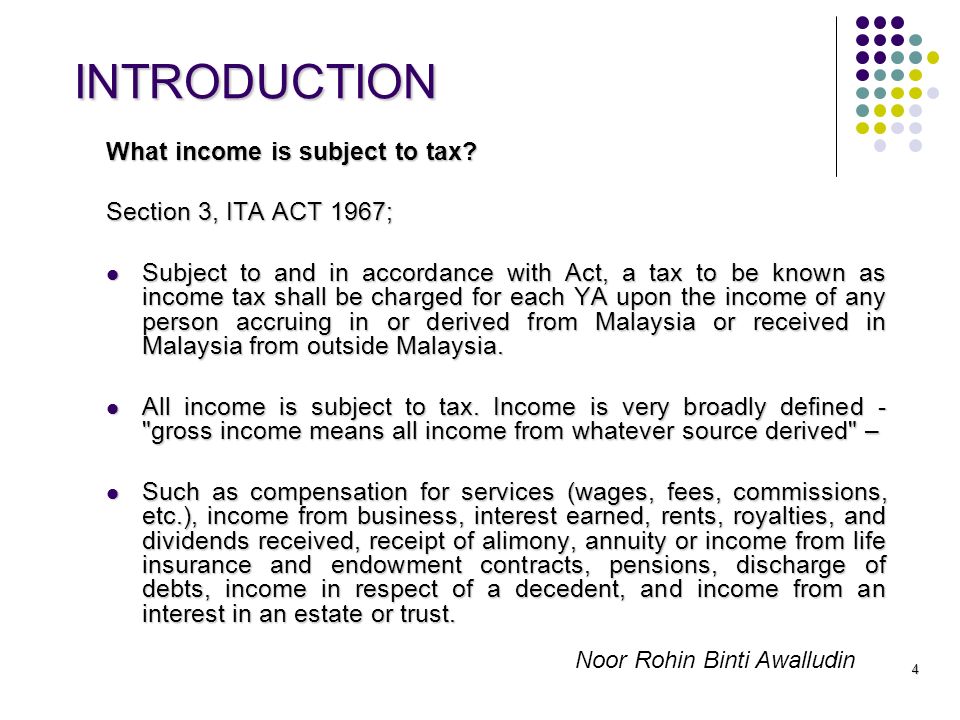

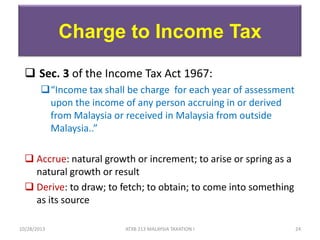

All classes of income under Section 4 of the Income Tax Act 1967 excluding a source of income from a partnership business in Malaysia b 根据2016年公司法令下注册或成立. INCOME TAX ACT 1967 Click here to see Annotated Statutes of this Act Part I PRELIMINARY SECTION 1Short title and commencement 2Interpretation Part II IMPOSITION AND. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income.

The most recent study was undertaken in Malaysia where a readability examination was conducted on the Income Tax Act 1967 ITA 1967 using FRES and F-KGL. And b thereafter where the members funds of such co-operative society as. Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received.

Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text.

Taxation Of Foreign Source Income In Malaysia International Tax Review

Solved Taxation In Malaysia 2020 5 A Payer Who Pays Chegg Com

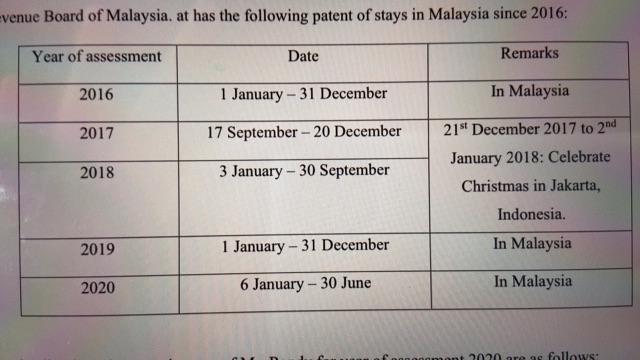

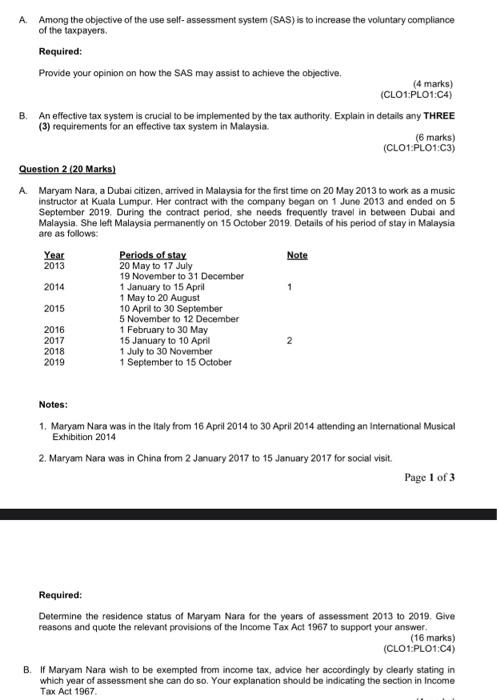

Solved Discuss The Resident Status Under Section 7 Of Income Chegg Com

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Core

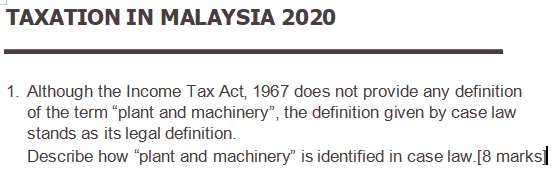

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Asia Briefing Individual Income Tax In Malaysia For Expatriates

Taxation Of Foreign Source Income In Malaysia International Tax Review

How The Finance Bill 2021 Affects Your Commission

Micci Malaysian International Chambers Of Commerce Industry

Section 140 And 140a Income Tax Act 1967 Part 2 Legally Malaysians

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development Happy Students

Taxing Foreign Sourced Income A Step Too Far Kpmg Malaysia

Income How Judges Determined Noor Rohin Binti Awalludin Ppt Video Online Download

Balancing Act Countering Digital Disinformation While Respecting Freedom Of Expression Broadband Commission Research Report On Freedom Of Expression And Addressing Disinformation On The Internet

Solved A Among The Objective Of The Use Self Assessment Chegg Com

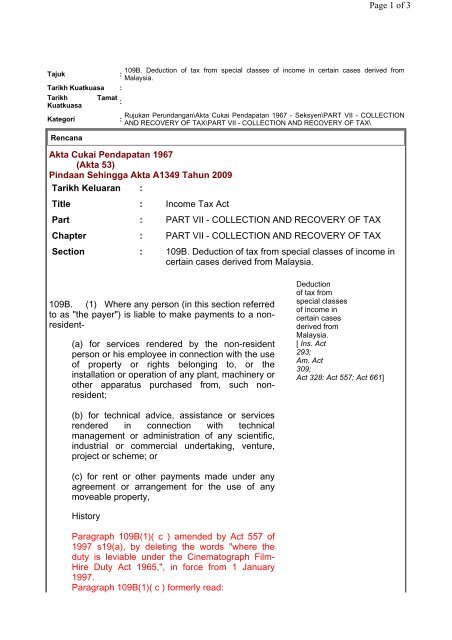

109b Deduction Of Tax From Special Classes Of Income In Certain

Chapter 6 Business Income Students